Introduction

Free EMI Calculator tools play an important role in today’s fast-paced financial world, where loans have become an essential part of life. Whether it is buying a house, purchasing a car, funding higher education, or meeting personal expenses, people rely on loans to achieve their goals without long waiting periods. However, taking a loan also means committing to monthly repayments called EMIs (Equated Monthly Installments). Understanding your monthly EMI in advance is crucial for smart financial planning.

This EMI Calculator tool is built using PromptXL to provide fast, accurate, and user-friendly loan EMI calculations. Users can easily calculate monthly EMI, interest amount, and total repayment by entering the loan amount, interest rate, and tenure. The tool is designed for real users who want a simple and reliable way to calculate loan EMI online without any complexity.

Using a free online EMI calculator helps remove confusion, saves time, and allows you to plan your finances better. Instead of doing complex manual calculations, you can calculate loan EMI online instantly and make informed decisions with confidence.

In this blog, we will explain everything you need to know about EMI calculators—what EMI is, how a loan EMI calculator works, its benefits, different loan types, and how to use a free EMI calculator effectively to make smarter financial decisions.

What Is a Free EMI Calculator?

EMI stands for Equated Monthly Installment. It is the fixed amount that a borrower pays to the lender every month until the loan is fully repaid. An EMI consists of two main components:

- Principal Amount – The original loan amount borrowed

- Interest – The cost charged by the lender for borrowing money

At the beginning of the loan tenure, a larger portion of the EMI goes toward interest. As time passes, the interest portion reduces, and more of the EMI goes toward repaying the principal.

Knowing your EMI in advance helps you understand whether a loan fits within your monthly budget and prevents financial stress in the future.

How to Calculate Loan EMI Online Using a Free EMI Calculator

A Free EMI Calculator is an online financial tool that allows users to calculate their monthly loan installment without any cost. It uses a standard EMI formula to give accurate results instantly.

Unlike manual calculations, an online EMI calculator:

- Is fast and error-free

- Requires no financial expertise

- Works for different loan types

- Can be used anytime, anywhere

Most EMI calculators are web-based and mobile-friendly, making them accessible to everyone.

EMI Calculator Formula Explained for Loan EMI Calculation

An EMI calculator works using a mathematical formula. While users don’t need to remember this formula, understanding it helps in knowing how EMIs are calculated.

EMI Formula:

EMI =

P × R × (1 + R)ⁿ / [(1 + R)ⁿ − 1]

Where:

- P = Loan amount (Principal)

- R = Monthly interest rate (Annual rate ÷ 12 ÷ 100)

- N = Loan tenure in months

The calculator automatically applies this formula in the background and displays the EMI amount instantly.

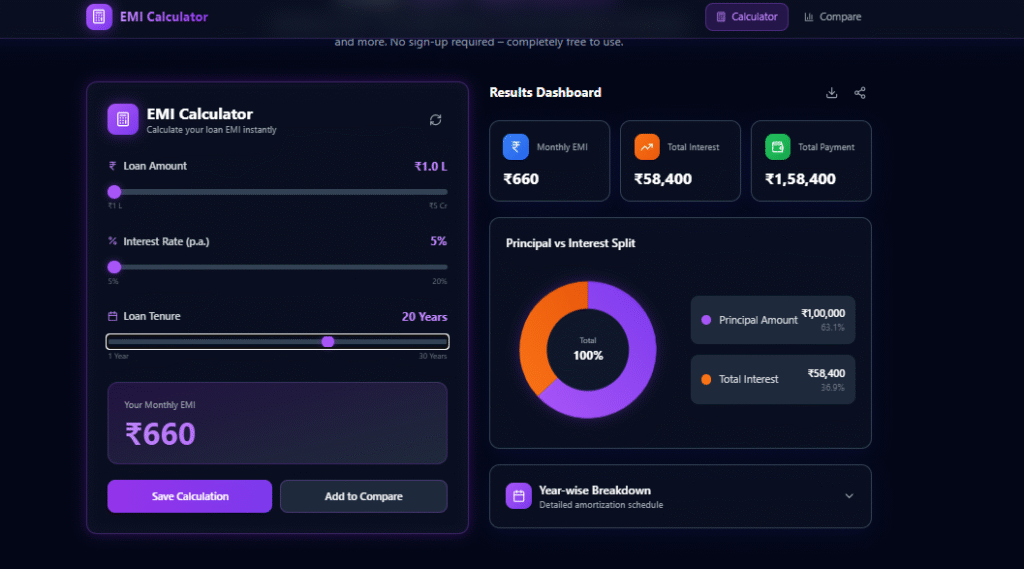

How to Use a Free EMI Calculator Online

Using an online EMI calculator is very simple. Follow these easy steps:

- Enter Loan Amount

Input the total amount you plan to borrow. - Enter Interest Rate

Add the annual interest rate offered by the bank or lender. - Select Loan Tenure

Choose the duration of the loan in months or years. - View EMI Result

The calculator instantly shows your monthly EMI amount.

Many advanced EMI calculators also show:

- Total interest payable

- Total repayment amount

- EMI breakup (principal vs interest)

Benefits of Using a Free EMI Calculator

1. Accurate Financial Planning

An EMI calculator helps you plan your monthly expenses in advance. You can check whether the EMI fits your income and avoid over-borrowing.

2. Saves Time

Manual EMI calculation is time-consuming and complex. A free EMI calculator gives instant results in seconds.

3. Compare Loan Options

You can compare different loan amounts, interest rates, and tenures to choose the best loan option.

4. Completely Free

As the name suggests, a free EMI calculator costs nothing. You can use it unlimited times without any registration.

5. User-Friendly

Most EMI calculators are designed with simple input fields, making them easy to use even for beginners.

Types of Loans You Can Calculate Using an EMI Calculator

A free EMI calculator can be used for various types of loans, including:

Home Loan EMI

Home loans usually have long tenures and large amounts. An EMI calculator helps you understand long-term repayment commitments.

Personal Loan EMI

Personal loans have higher interest rates. Calculating EMI helps ensure affordability.

Car Loan EMI

Car loan EMIs can be calculated to decide between different vehicle models and loan offers.

Education Loan EMI

Students and parents can plan future repayments with an education loan EMI calculator.

Business Loan EMI

Entrepreneurs can estimate monthly repayments before applying for a business loan.

Why EMI Calculation Is Important Before Taking a Loan

Many borrowers make the mistake of focusing only on loan approval and interest rates, ignoring EMI planning. This can lead to financial stress later.

Using a free EMI calculator before taking a loan helps you:

- Avoid missed payments

- Maintain a good credit score

- Choose a suitable loan tenure

- Balance savings and expenses

Proper EMI planning ensures financial stability and peace of mind.

Factors That Affect Your EMI Amount

Several factors influence your EMI amount:

Loan Amount

Higher loan amounts result in higher EMIs.

Interest Rate

Even a small difference in interest rate can significantly affect your EMI.

Loan Tenure

Longer tenure reduces EMI but increases total interest paid.

Type of Interest

Fixed or floating interest rates can impact monthly EMI stability.

Using an EMI calculator allows you to adjust these factors and find the best balance.

EMI Calculator vs Manual Calculation

| Feature | EMI Calculator | Manual Calculation |

|---|---|---|

| Speed | Instant | Time-consuming |

| Accuracy | High | Prone to errors |

| Ease of Use | Very easy | Complex |

| Accessibility | Online, anytime | Needs formula & calculator |

Clearly, an online EMI calculator is the smarter choice.

EMI Calculator for Budget Planning

A free EMI calculator is not just a loan tool—it is also a budgeting assistant. By knowing your EMI in advance, you can:

- Plan monthly savings

- Avoid unnecessary expenses

- Set financial goals

- Maintain emergency funds

It helps create a disciplined financial lifestyle.

Common Mistakes to Avoid While Using EMI Calculators

- Entering incorrect interest rates

- Ignoring additional charges like processing fees

- Choosing very long tenure without considering total interest

- Not comparing multiple loan options

Always double-check inputs and compare results before finalizing a loan.

Who Should Use a Free EMI Calculator?

A free EMI calculator is useful for:

- Salaried employees

- Business owners

- Students and parents

- First-time loan applicants

- Anyone planning to borrow money

It is suitable for both beginners and experienced borrowers.

Advantages of Online EMI Calculators Over Bank Tools

While banks provide EMI calculators, free online EMI calculators offer:

- No login or registration

- Faster loading

- Simple design

- Multiple loan comparison

They are ideal for quick and independent financial planning.

EMI Calculator on Mobile Devices

Most modern EMI calculators are mobile-friendly. You can calculate EMIs on:

- Smartphones

- Tablets

- Laptops

This makes financial planning convenient even on the go.

Future of EMI Calculators

With the growth of digital finance, EMI calculators are becoming more advanced. Future features may include:

- AI-based loan suggestions

- Personalized EMI plans

- Real-time bank rate updates

- Integrated financial dashboards

Free EMI calculators will continue to play a key role in smart financial decisions.

Conclusion

A Free EMI Calculator – Calculate Loan EMI Online Easily is an essential financial tool for anyone planning to take a loan. It simplifies complex calculations, saves time, and helps you make informed decisions. By using an EMI calculator, you gain clarity on your monthly obligations and avoid financial surprises.

Whether you are planning a home loan, car loan, personal loan, or education loan, an online EMI calculator empowers you to choose the best option that suits your budget. Before signing any loan agreement, always calculate your EMI and plan your finances wisely.

Start using a free EMI calculator today and take control of your financial future with confidence.

🚀 Build Without Platform Limits

Create your project: https://app.promptxl.com

Learn more: https://promptxl.com