Introduction

As businesses grow, their financial structures become more complex. Managing finances across subsidiaries, departments, regions, or legal entities can quickly turn into a challenging and error-prone process. This is where financial consolidation software becomes essential. For multi-entity organizations, accurate and timely financial consolidation is critical for compliance, decision-making, and strategic planning.

In this guide, we’ll explore what financial consolidation is, how it works, why it’s important for multi-entity organizations, key features, benefits, challenges, and how to choose the right solution for your business.

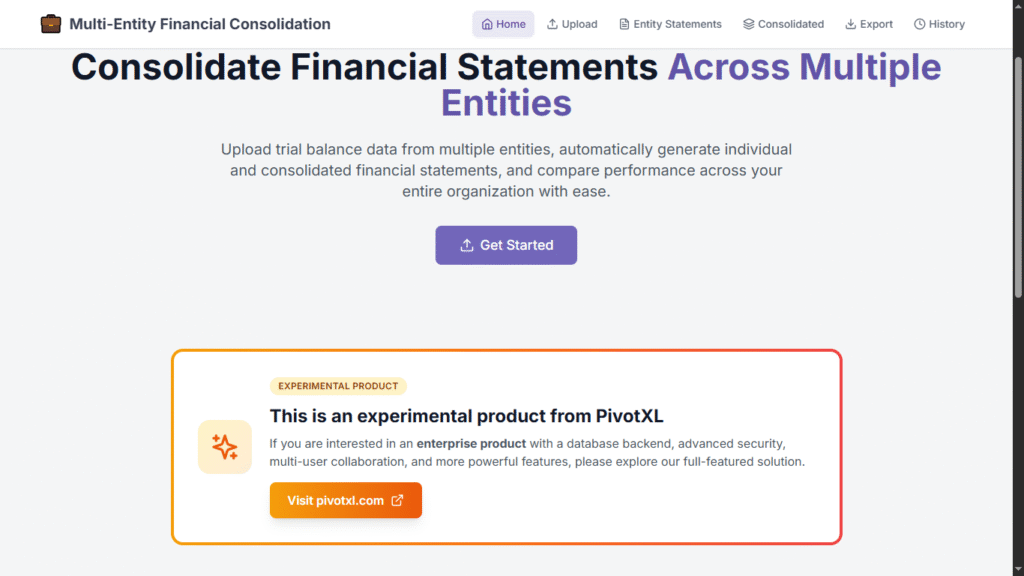

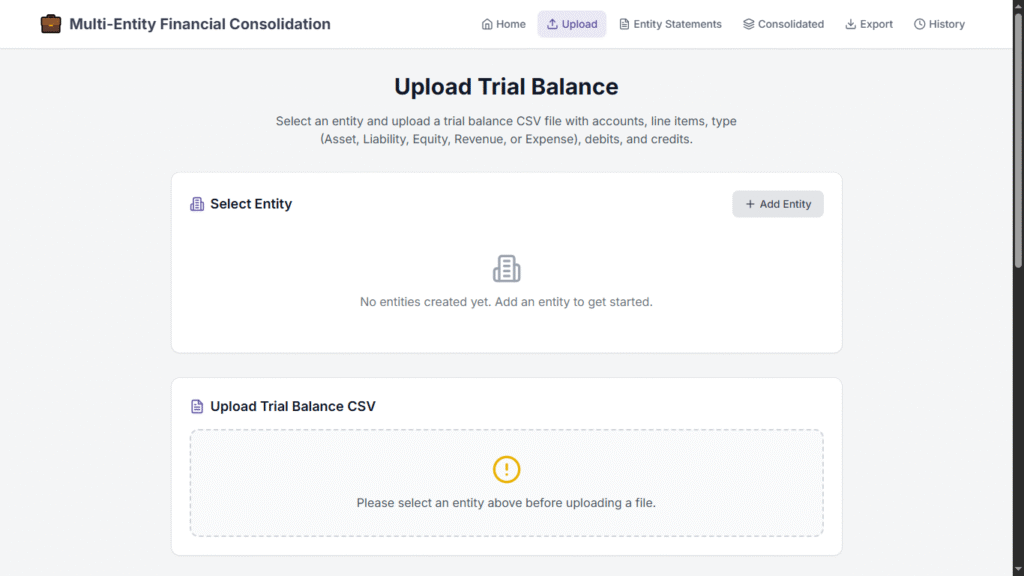

Click The App Link : Multi-Entity Financial Consolidation

What Is Financial Consolidation Software?

Financial consolidation is a system that collects, standardizes, and combines data from multiple entities into a single set of consolidated statements. These entities may include subsidiaries, branches, departments, or business units operating across different regions or currencies.

Instead of manually merging spreadsheets or relying on disconnected accounting systems, financial consolidation automates the entire consolidation process. This ensures accuracy, consistency, and compliance with accounting standards.

Understanding Financial Consolidation in Multi-Entity Organizations

Multi-entity organizations often operate with separate accounting systems, charts of accounts, and reporting requirements. Financial consolidation brings all this data together to provide a unified financial view of the organization.

What Financial Consolidation Includes

- Combining balance sheets, income statements, and cash flow statements

- Eliminating intercompany transactions

- Converting multiple currencies into a base currency

- Applying consistent accounting rules

- Generating consolidated financial reports

Without financial consolidation these tasks are time-consuming and highly prone to errors.

Why Financial Consolidation Software Is Essential

Manual consolidation using spreadsheets may work for small organizations, but it becomes unsustainable as the business grows. Financial consolidation solves many critical challenges.

Key Reasons to Use Financial Consolidation:

- Accuracy and Consistency

Automation reduces human errors and ensures uniform accounting rules. - Time Savings

Consolidation cycles that once took weeks can be completed in hours or days. - Regulatory Compliance

Ensures compliance with accounting standards and audit requirements. - Real-Time Visibility

Leaders gain faster insights into group financial performance. - Scalability

Easily supports new subsidiaries, entities, and regions.

How Financial Consolidation Software Works

Financial consolidation follows a structured process to produce accurate group financial statements.

Step 1: Data Collection

Financial data is imported from multiple accounting systems or ERPs used by different entities.

Step 2: Data Standardization

The software maps different charts of accounts into a standardized group structure.

Step 3: Currency Conversion

Foreign currency transactions are converted using predefined exchange rates.

Step 4: Intercompany Elimination

Transactions between related entities are identified and eliminated to avoid duplication.

Step 5: Consolidation

The system aggregates all validated data into consolidated financial statements.

Step 6: Reporting and Analysis

Users generate reports, dashboards, and compliance-ready financial statements.

Key Features of Financial Consolidation Software

A powerful financial consolidation solution includes features designed specifically for multi-entity environments.

1. Multi-Entity Management

Manage unlimited subsidiaries, divisions, and legal entities in one system.

2. Intercompany Elimination

Automatically identifies and removes intercompany balances and transactions.

3. Multi-Currency Support

Handles currency conversion with real-time or historical exchange rates.

4. Chart of Accounts Mapping

Aligns different accounting structures into a unified reporting format.

5. Automated Consolidation Rules

Applies predefined consolidation logic consistently across all entities.

6. Financial Reporting & Dashboards

Generates consolidated reports, variance analysis, and performance insights.

7. Audit Trails & Controls

Tracks changes, approvals, and adjustments for compliance and transparency.

Benefits of Financial Consolidation Software

Implementing financial consolidation delivers both operational and strategic advantages.

Faster Financial Close

Shorten monthly, quarterly, and annual close cycles.

Improved Data Accuracy

Reduce errors caused by manual data entry and spreadsheet formulas.

Better Decision-Making

Access real-time consolidated financial data for strategic planning.

Reduced Compliance Risk

Maintain accurate records and audit-ready financial statements.

Centralized Financial Control

Manage group-level finances from a single platform.

Financial Consolidation Challenges

Organizations that rely on manual processes face several challenges.

Spreadsheet Complexity

Large spreadsheets are difficult to maintain, audit, and update.

Data Inconsistencies

Different accounting methods lead to unreliable consolidated results.

Delayed Reporting

Manual consolidation slows down financial close and reporting cycles.

High Error Risk

Even small mistakes can significantly impact financial accuracy.

Financial consolidation eliminates these issues by automating and standardizing the process.

Financial Consolidation for Growing and Global Businesses

As businesses expand globally, financial consolidation becomes more complex.

Common Scenarios

- Multiple subsidiaries in different countries

- Operations in multiple currencies

- Diverse accounting standards and tax regulations

Financial consolidation provides centralized control while supporting local compliance requirements, making it ideal for international organizations.

Types of Financial Consolidation Software

Different organizations require different consolidation solutions.

Cloud-Based Financial Consolidation.

Accessible from anywhere, scalable, and cost-effective.

On-Premise Consolidation Systems

Preferred by organizations with strict data control requirements.

Enterprise Financial Consolidation Platforms

Designed for large organizations with complex reporting needs.

Mid-Market Consolidation Solutions

Ideal for growing businesses transitioning from spreadsheets.

How to Choose the Right Financial Consolidation Software

Selecting the right financial consolidation software is a strategic decision.

Key Evaluation Criteria

- Number of Entities Supported

Ensure the software scales with your organization. - Ease of Implementation

Quick setup reduces disruption to finance teams. - Integration Capabilities

Must integrate with existing accounting and ERP systems. - Automation Level

Look for automated eliminations, conversions, and validations. - Reporting Flexibility

Customizable reports and dashboards are essential. - Security & Compliance

Strong access controls and audit trails are mandatory.

Best Practices for Financial Consolidation

To maximize the value of financial consolidation software, follow these best practices:

- Standardize charts of accounts across entities

- Define clear intercompany rules

- Automate validation checks

- Perform regular reconciliations

- Train finance teams thoroughly

The Future of Financial Consolidation Software

Financial consolidation software continues to evolve with new technologies.

Emerging Trends

- AI-driven anomaly detection

- Predictive financial analytics

- Real-time consolidation

- Advanced visualization dashboards

Organizations adopting modern consolidation tools gain faster insights and stronger financial control.

Frequently Asked Questions (FAQs)

What is financial consolidation software used for?

Financial consolidation software is used to combine financial data from multiple entities into consolidated financial statements.

Who needs financial consolidation software?

Multi-entity organizations, holding companies, and global businesses benefit the most.

Can small businesses use financial consolidation software?

Yes, many scalable solutions are designed for growing and mid-sized organizations.

Does financial consolidation software support compliance?

Yes, it helps meet accounting standards and audit requirements.

Conclusion

Financial consolidation software is a critical solution for multi-entity organizations aiming to maintain accuracy, transparency, and efficiency in financial reporting. By automating consolidation processes, eliminating manual errors, and providing real-time financial visibility, it empowers finance teams to focus on strategy rather than spreadsheets.

As organizations grow in size and complexity, investing in the right financial consolidation software becomes not just beneficial—but essential for long-term success.

Built with speed, designed for trust

The application was built in minutes using PromptXL, yet it delivers production-grade usability and security. It demonstrates how modern AI-assisted tooling can create polished, real-world software quickly—without sacrificing quality.

🚀 Build Without Platform Limits

Create your project: https://app.promptxl.com

Learn more: https://promptxl.com